5 OCTOBER 2022

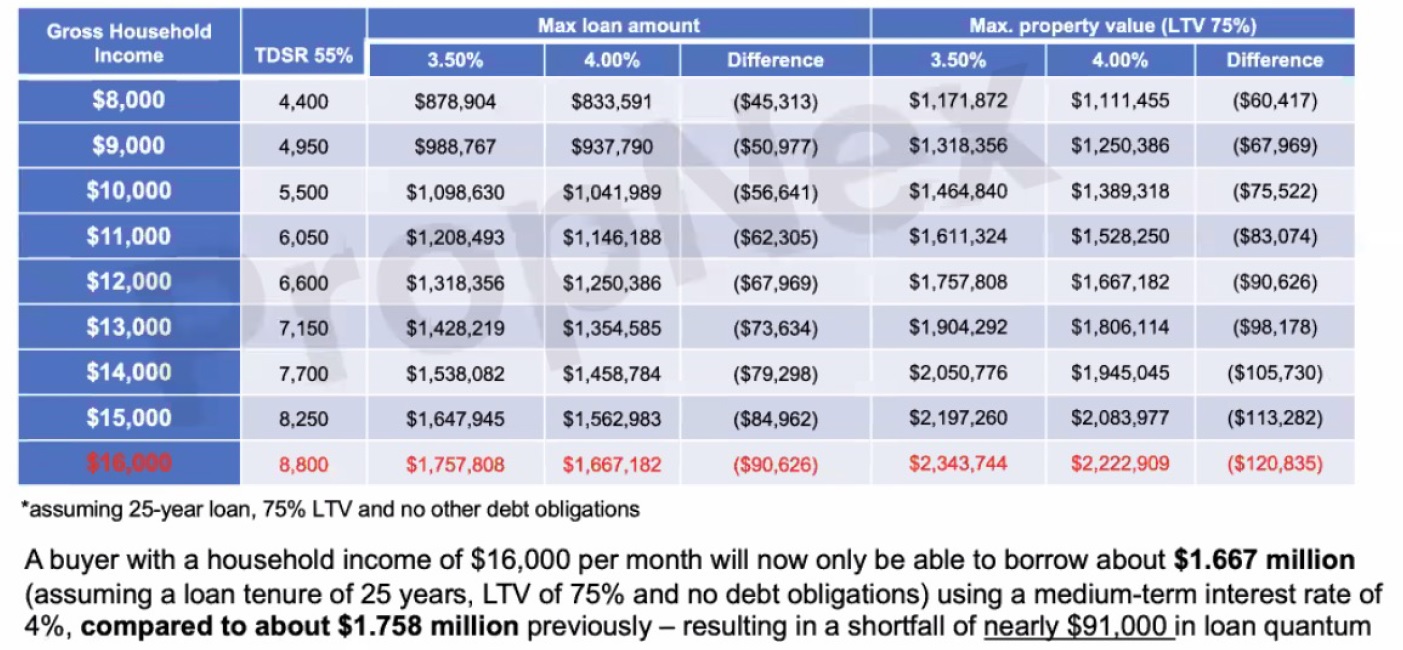

For the tdsr adjustment of using 4% instead of 3.5% as means of loan assessment, this is something that was being talked about for quite a while.

You see, the reason is that the Gov always want to promote a ‘sustainable’ property market. If you read the media often enough, you will see the word ‘sustainable’ being used many times.

So what does sustainable means to the Gov?

I think there are certain indicators that they want to make sure that the property growth is supported by the fundamentals.

For example, GDP growth, average household income, unemployment rate, etc. I’m sure these are the data & statistics that policy makers are tracking and have even more deep data compared to the common folks like us.

The last thing Gov will probably want is a mass selling of properties, that will trigger many foreclosures happening, and that is when many people are ‘throwing’ away their properties.

If the interest rates continue to increase and many people start to feel the stretch and starting to sell properties, that may trigger some force sales in the market.

Instead of risking that from happening, one of the way is to set the barrier of entry higher to make sure that those who require debt to finance their properties are able to endure a higher threshold if interests rates were to increase higher.

Given that this round of cooling measures came just 9 months after the previous ones, I will believe that active monitoring of the property market is expected.

If the market continues to perform irrationally, I’m not surprised that there will certainly be another round of cooling measures coming along.

Join The Discussion