What is annual value and how this news will affect you?

In short, according to IRAS website, the property annual value is an “estimated gross annual rent of the property if it were to be rented out, excluding furniture, furnishings and maintenance fees”

What it means that if you have bought a $1.5m property and got a monthly rental of $5000, the annual value of the house theoretically should be at $60,000.

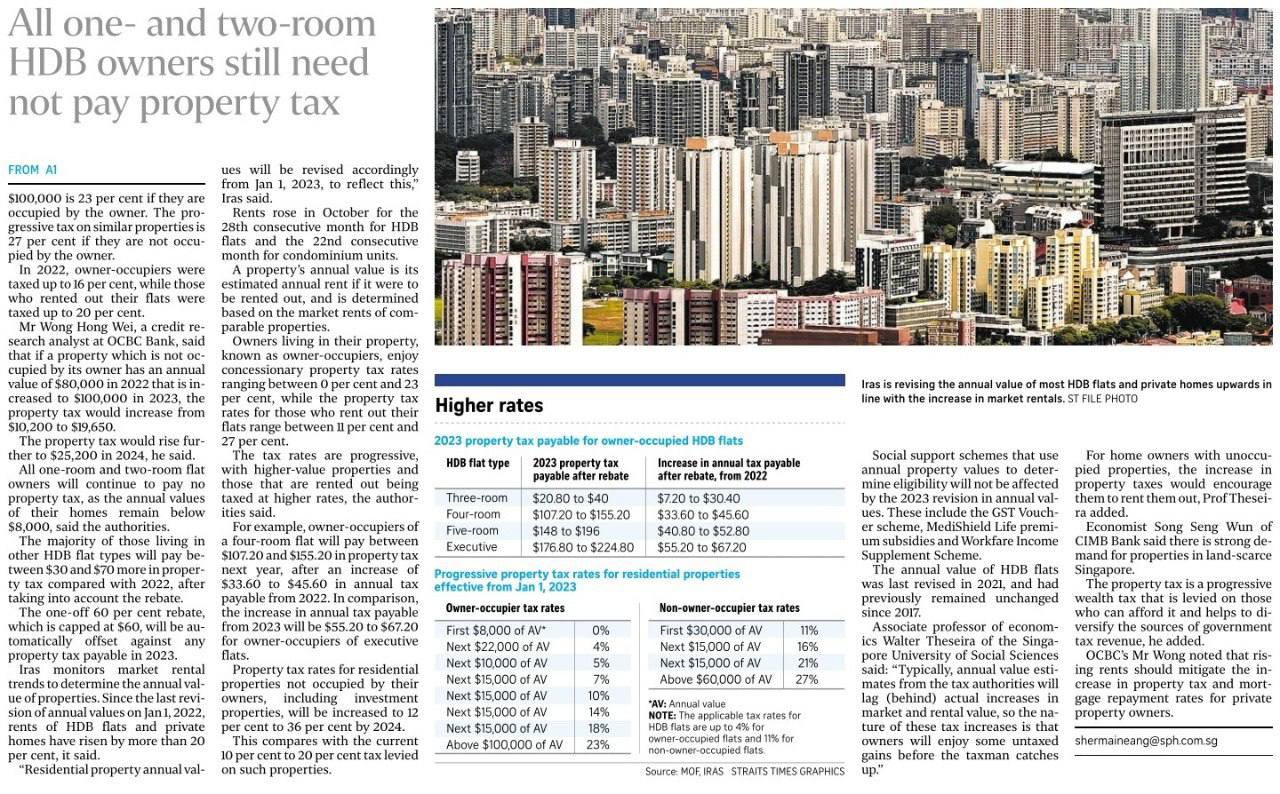

This will be how it looks like broken down in the calculations

Non-Owner occupier rate based on $60,000 annual value

Year 2022: ($30,000 X 10%) + ($15,000 x 12%) + ($15,000 x 14%) = $6,900

Year 2023: ($30,000 x 11%) + ($15,000 x 16%) + ($15,000 X 16%) = $8,850

Year 2024: ($30,000 x 12%) + ($6,000 x 20%) + ($15,000 X 28%) = $10,800

This calculation is only for properties that are rented out.

For owner occupied properties, the changes is not as significant except for high end and luxury segment, so for purpose of discussion, I will be covering mainly about rental properties.

How these latest announcements affect you as an investor?

The higher property tax rates was first announced in the budget during 18 February 2022.

There is a growing concern on the rich grabbing up more properties and hot money coming into Singapore driving up the property prices.

The changes in the property tax calculation is being used as a means to collect more taxes to distribute to the lower income households, in some sense, some analysts called this a form of wealth tax.

Indeed, the majority of single property HDB owners will not be very much impacted by the changes. This is because that the annual value largely remains unchanged for majority of the HDBs as well.

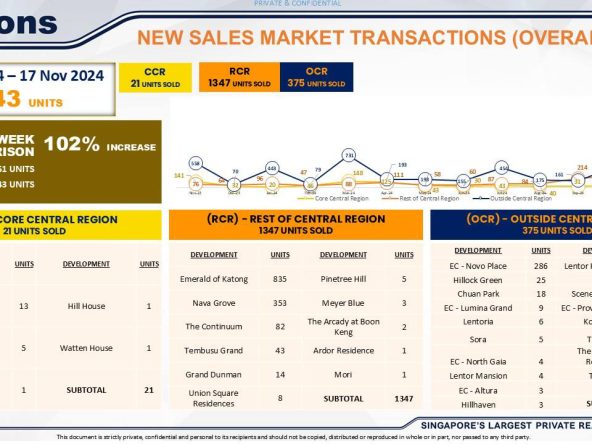

Since Q3 2020 leading up till now, the rental market has been increasing in an alarming rate.

And it doesn’t come as a surprise that the annual value of all properties will be increased in the year 2023.

Because as the IRAS has clearly stated that the annual value is derived based on the estimated gross annual value of the rent.

However in actual fact, most of the time, I spoke with the property owners, I understand that the annual value is lower than the actual rental amount that they got.

So how do you find out the actual annual value?

You can buy the information from IRAS as long as you have the full address of the property.

Or if you’re planning to buy a property purely for investment purpose and worried that the annual value may be too high, this is one of the way you can check.

Link as below:

https://www.iras.gov.sg/taxes/property-tax/property-professionals/real-estate-housing-agents/find-out-annual-values

For owners who are already owning rental properties or owner occupiers staying in high end luxury properties, the property tax increase is a testament that the Gov will find means and ways to increase their tax revenue from the privileged and upper class.

On behalf of the rest of the population, I would like to thank you for your contribution towards nation building.

Subscribe to this telegram channel to receive daily property news update:

https://t.me/johntanproperty

#theinsightfulrealtor #sgproperty #sgrealtor #johntanthepropertyagent #buysellrent #condosg #propertyinvestment #propertysg #hdbsg