Is 2024 Going to Be the Same Old Same Old?

As we step into the new year, everyone’s curious about what’s in store for the real estate market. Many folks looking to buy or sell property are contemplating their next big move, understanding that it’s not as simple as buying vegetables.

In the HDB market, prices and volume are expected to grow, although at a slower pace. Government policies aim to keep public housing affordable, with more grants for first time buyers to prevent disrupting resale market prices. This way, first time buyers can afford homes without affecting sellers’ prices.

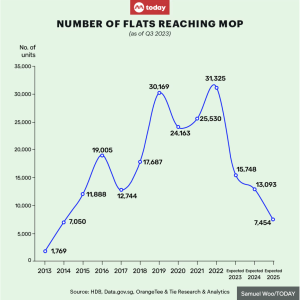

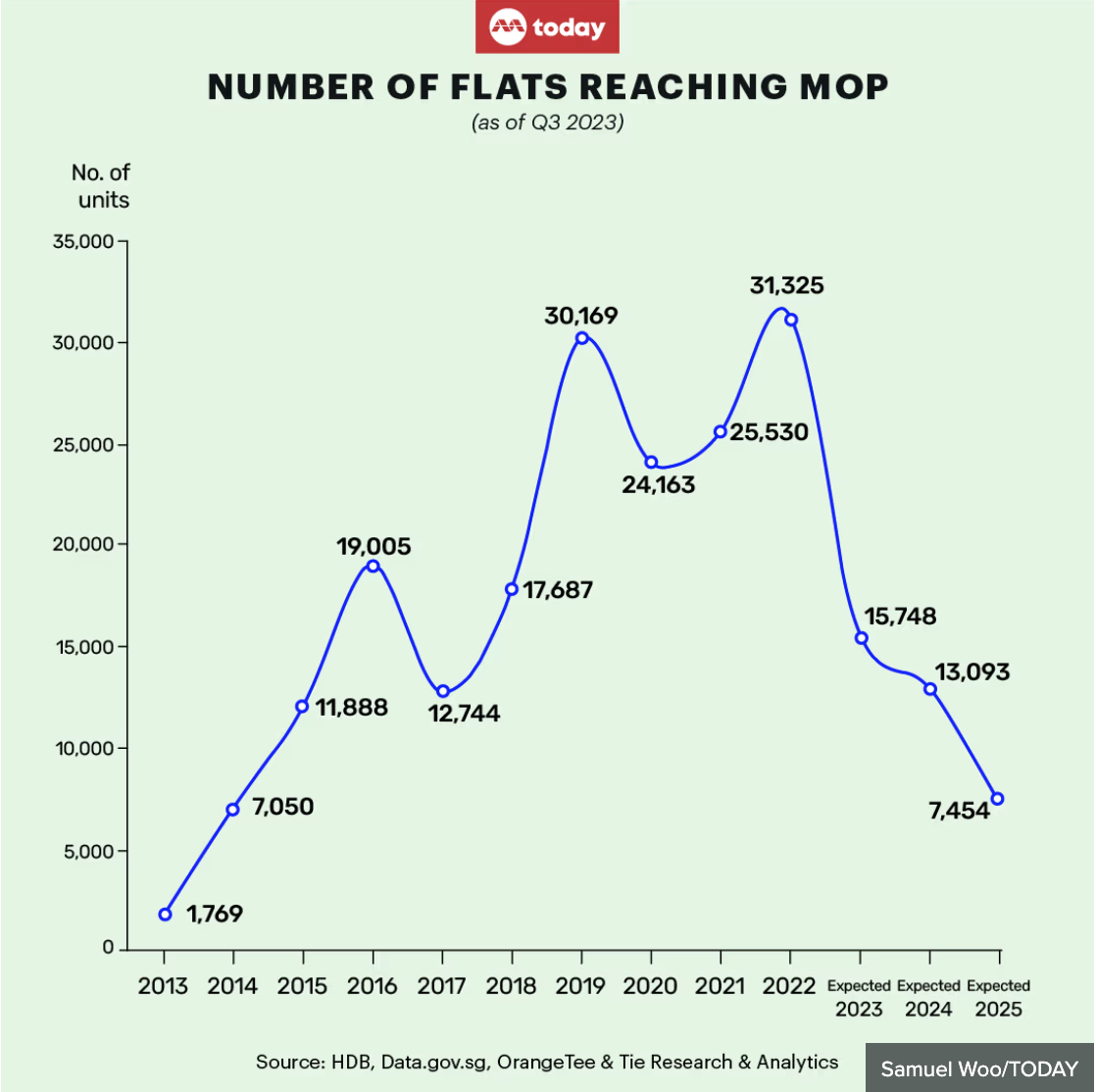

The recently introduced standard, plus, and prime scheme is a hot topic, setting the stage for the future of public housing. With stricter rules in place, homebuyers face decisions between a good location and future upgrade flexibility. The 10-year lock in period could impact the resale HDB market in the long run.

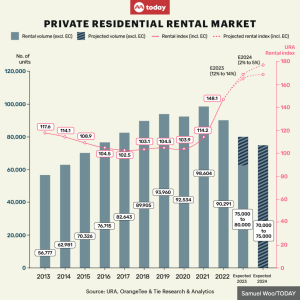

On the private market front, condo owners are encountering price resistance in renting out their units due to a surge in supply in 2023. While 2024 will see less supply, rental prices are expected to remain steady. Landlords, dealing with higher holding costs, may face a challenge against tenants with more options.

The recent URA announcement changing the occupancy limit from 6 to 8 pax benefits landlords with larger units seeking higher rentals. However, the question arises, Why wasn’t this implemented earlier during the 2021/22 rental hike period?

For private residential units, I anticipate a shift in focus towards realistically priced resale units that remain comfortably affordable for homebuyers. New project launches are expected to set another record high in 2024, with developers constrained by higher land bid costs and choosing better land plots.

Well priced new launches with a strong growth story will likely to perform well in 2024, driven by underlying demand from nearby potential buyers.

My business style remains client-centric, guiding clients through different life stages to achieve their real estate goals. Continuous learning and quick adaptation to market changes are key for sustainable success.

Wishing you and your family a prosperous 2024 ahead!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~ LIVE BANK RATES UPDATES 3rd JAN

~ Welcome to enquire valuation, hdb, pte, decoupling, bridging loan, construction, renov, strategies etc

[NEWS YOU MUST KNOW]

– US Inflation remained @ 3% for Nov & Dec

– Inflation result gave policymaker confidence to publish 0.75% rate cut offical projection in 2024.

– This equates to estimate 15% drop for SG SORA

– SG Banks might raise fixed rates as it has finally reached discount threshold

[BEST RATES FOR COMPLETED PPTY]

– 2yrs Fixed Rates 3.15 3.15 (>300k)

– 2yrs Fixed Rates 3.10 3.10 (>500k)

– 2yrs Fixed Rates 3.00 3.00 (>700k) Limited Time

[BEST RATES FOR UNCOMPLETED PPTY]

– 4yrs Bank Spread 0.50% + 3mth SORA (>500k)

– 4yrs Bank Spread 0.45% + 3mth SORA (>700k)

SG CENTRAL BANK

3MTH SORA PRESENTLY @ 3.75

Join The Discussion