Let’s read deeper into the news..

Let’s read deeper into the news..

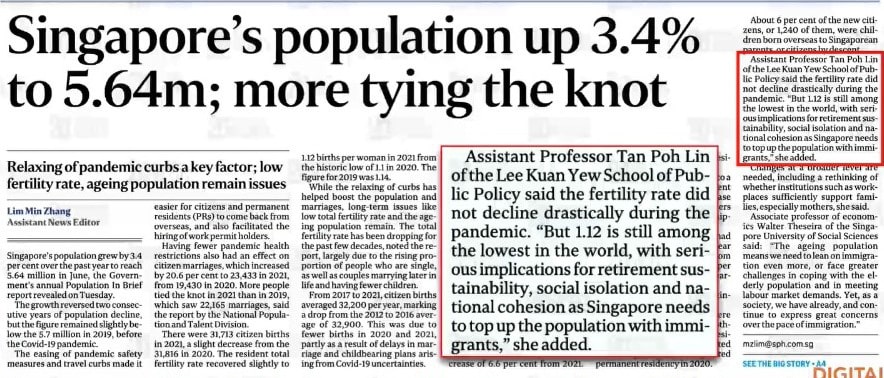

“..with serious implications for retirement sustainability, social isolation and national cohesion as Singapore needs to top up the population with immigrants”

What does this means?

You can see that there are so many major infrastructure projects ongoing in Singapore right now.

Greater Southern Waterfront, relocation of Paya Lebar Airbase, expansion of Airport and Seaport capabilities, extensive transportation networks with more MRT lines, just to name a few.

It is to prepare for a greater inflow of people coming into the country to work under team Singapore.

The fact is that Singapore is approaching a population if left to its natural progression, we will be facing an underpopulation situation. More simple man of saying, we have more people dying than people giving birth.

Which we can look at Japan as a most immediate case study, where they averaging a -0.09 to -0.24 drop in terms of population every year. It is a country that is well developed which does not suffer from mass exodus of emigration or poor medical conditions.

In contrast, the Singapore Gov is generally more open to foreigners coming into the country to contribute to the economy and gradually convert some of them to new citizens.

So how does this affect property prices?

If there is a population target of 7m by 2040, we are still 1.34m away from it.

A household size of 3.2 pax per household, we will probably need 418,750 additional housing units to cater for the inflow of people.

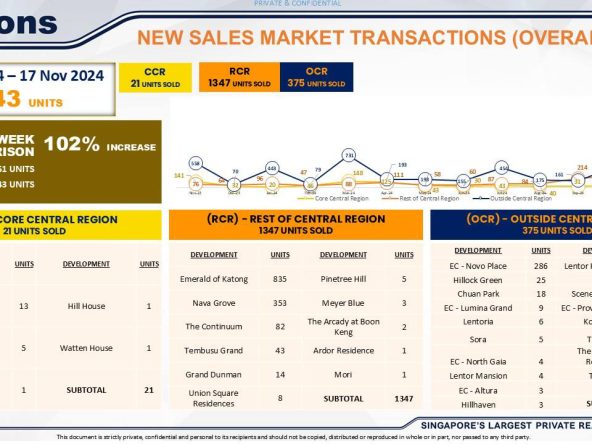

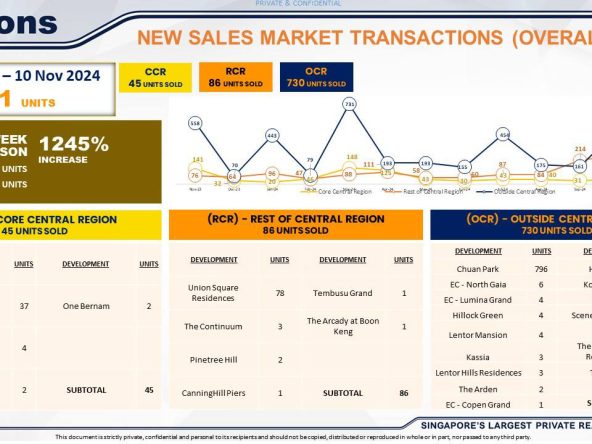

Which means for the next 18 years, on the average we will need 23,263 units to be build every year.

Does our current rate of building construction supports the numbers?

Personally, I see that the Gov is managing a fine balance of making sure there is enough net inflow every year yet at the same time, people are generally not annoyed by the by products of more new citizens coming in.

I think that in the past, they let too many people in too fast when the infrastructure is not yet ready. That’s probably why 2011 a GRC was lost.

This past 2 years, Covid hit badly, the construction sector cannot keep pace with the demand for housing, that’s why there is another sudden surge in terms of the property prices.