Singapore real estate market is a valuable tool to hedge against inflation in the long run. Despite recent short term uncertainties, such as the increase in Buyer Stamp Duty BSD, there are still opportunities to find good deals.

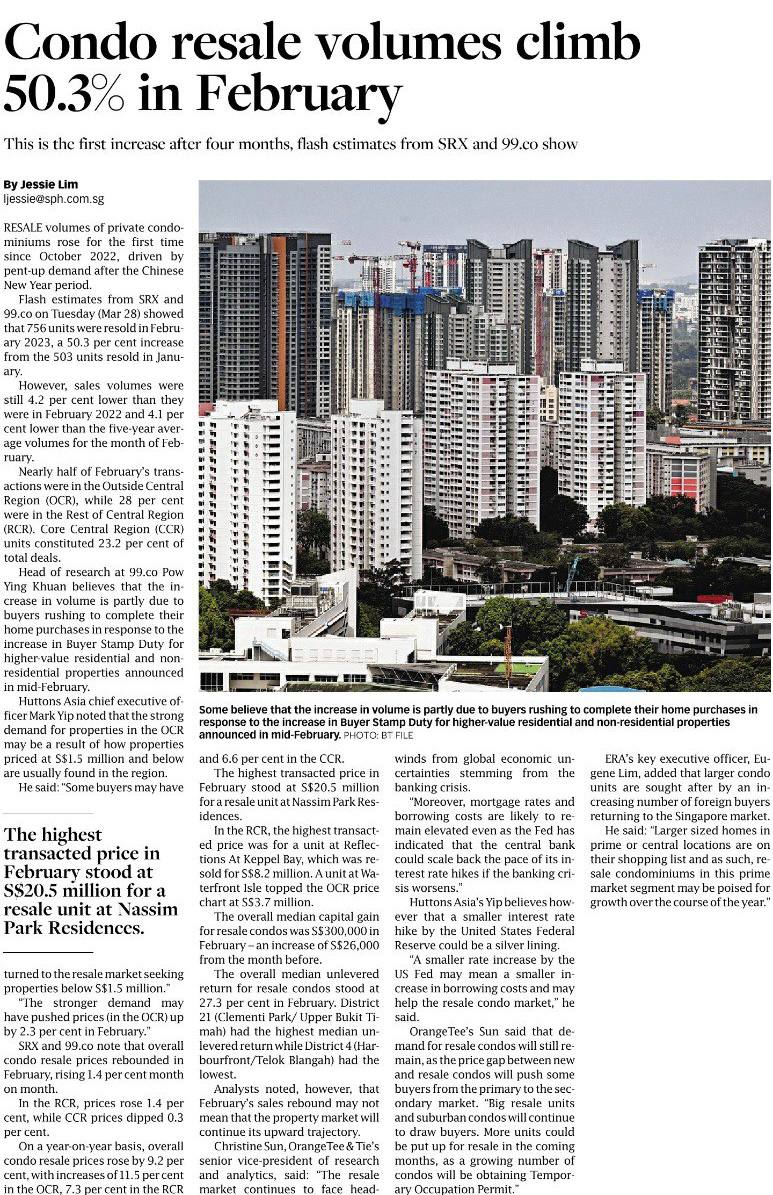

The surge in sales in Feb23 after 4 months is a positive sign for the market, indicating the strong underlying demand after the CNY period.

Nearly half of the transactions were in the Outside Central Region OCR, while 28% were in the Rest of Central Region RCR. And the highest transacted price was $20.5 million for a resale unit at Nassim Park Residences.

The increase in BSD for higher priced properties announced on Valentine’s Day caused some buyers to rush to make their home purchases before the new policy takes effect.

We continue to see larger resale units and OCR condos in high demand, and more units may be put up for resale in the coming months due to the pricing disparity.

While the market is still adjusting to the recent changes and global uncertainties, I believe there are opportunities for good deals that provide long term benefits.